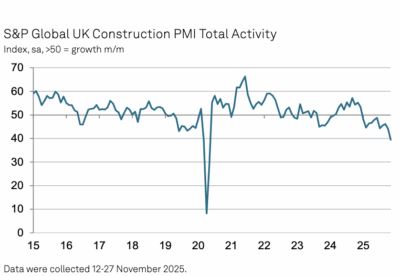

The latest bellwether S&P Global UK Construction Purchasing Managers’ Index fell to 39.4 in November from 44.1 in October.

It was the lowest reading since May 2020 while lower volumes of construction output have now been recorded for eleven months in a row.

Activity fell below the 50 no change mark in all sectors with housing activity (index at 35.4), commercial construction (43.8) and civil engineering (30.0) all plummeting.

Survey respondents commented on fragile market confidence, delays with the release of new projects and a general lack of incoming new work.

Looking ahead, the proportion of construction companies expecting an upturn in business activity in the next 12 months (31%) narrowly exceeded those forecasting a decline (25%).

Tim Moore, Economics Director at S&P Global Market Intelligence, said: “November data revealed a sharp retrenchment across the UK construction sector as weak client confidence and a shortfall of new project starts again weighed on activity.

“Total industry activity decreased to the greatest extent for five-and-a-half years, led by steep falls in infrastructure and residential building work. Commercial construction also faced severe headwinds during November as business uncertainty in the run up to the Budget pushed clients to defer investment decisions.

“Lower workloads, alongside pressure on margins from rising wages and purchasing costs, continued to dampen staff hiring in November. The latest round of job cuts was the most marked since August 2020.”

“Construction companies also signalled a slide in business activity expectations for the year ahead as hopes of an imminent rebound in sales pipelines faded in November. The degree of optimism dropped to its lowest since December 2022 amid reports of cutbacks to client budgets and pervasive worries about long-term UK economic growth prospects.”